As part of our ongoing effort to bring solid investment opportunities to our network, we’re excited to share a new one we’ve been quietly working on for several months across different parts of Florida.

Before you dive into the details on this page, here are a few quick points to keep in mind:

1. This opportunity is available to you because you’re part of the Simply Do It network. That connection gives you access to pricing and deals that wouldn’t typically be available to individual investors.

2. The properties are in three Florida markets: Ocala (near Orlando), North Port (south of Tampa), and Cape Coral.

3. This page focuses on Ocala, but similar properties are available in North Port and Cape Coral as well.

4. Pricing is below market value and in many cases lower than active listings for comparable homes.

Go ahead and review the information below, and if you have any questions, feel free to post them in the comments below (it’s easier for us to reply there than via email).

We’re here to help you explore whether this fits your investing goals.

Top Reasons to Consider This One

#1: Equity From Day One

Houses are priced at $50,000+ BELOW 2023 market value, meaning you start in the green. 📈

#2: Occupancy

Houses are tenant-occupied from day one. No leasing fee or vacancy! Immediate rental Income.

#3: New Construction, 2023-2024-2025 Built

New houses are built following the most recent FL building codes.

#4: Cash-flowing

While returns vary, properties generate immediate cash flow.

#5: Large Buying Group Leverage:

SDI has pre-negotiated discounts exclusively for our clients.

#6: High-Appreciation Markets

Properties are located in growing Florida areas across multiple locations.

#7: Direct Purchase From the Builder

No buyer’s agent needed, unless the buyer requests one (additional fees would apply).

#8: Impact costs to ALL builders recently was raised by $40k

This means that any new properties moving forward will have additional costs. These properties were built before this impact fee was levied, therefore, you are benefitting from the savings.

BONUS: Multi-Property Discounts

Multiple properties, multiple areas – Prices vary and are different between the locations, and so is the discount amount we can get for you.:

Why Florida - Market Dynamics and Investment Rationale

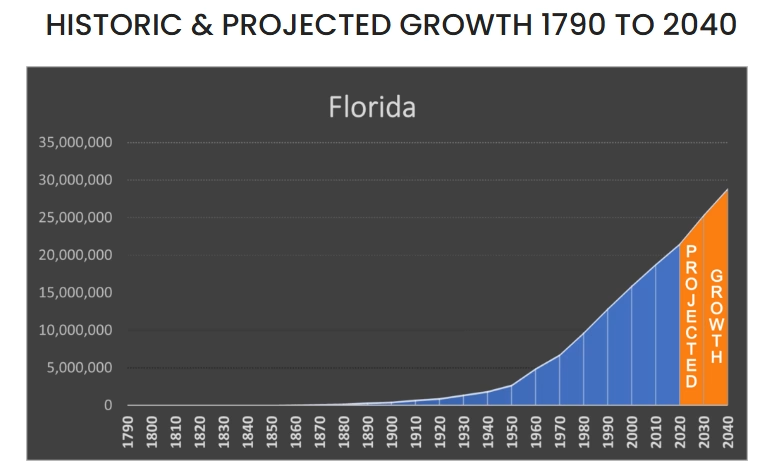

1. Population Growth in Target Market

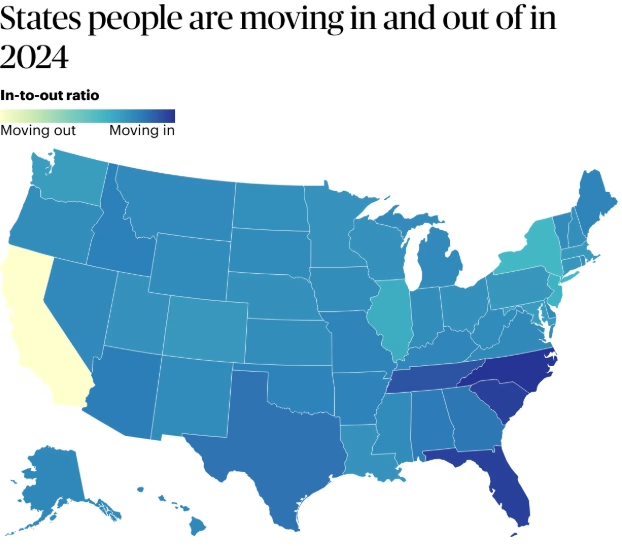

- Florida consistently ranks top 5 in U.S. migration trends. Cape Coral is now 15th nationwide for inbound relocations, driving housing demand.

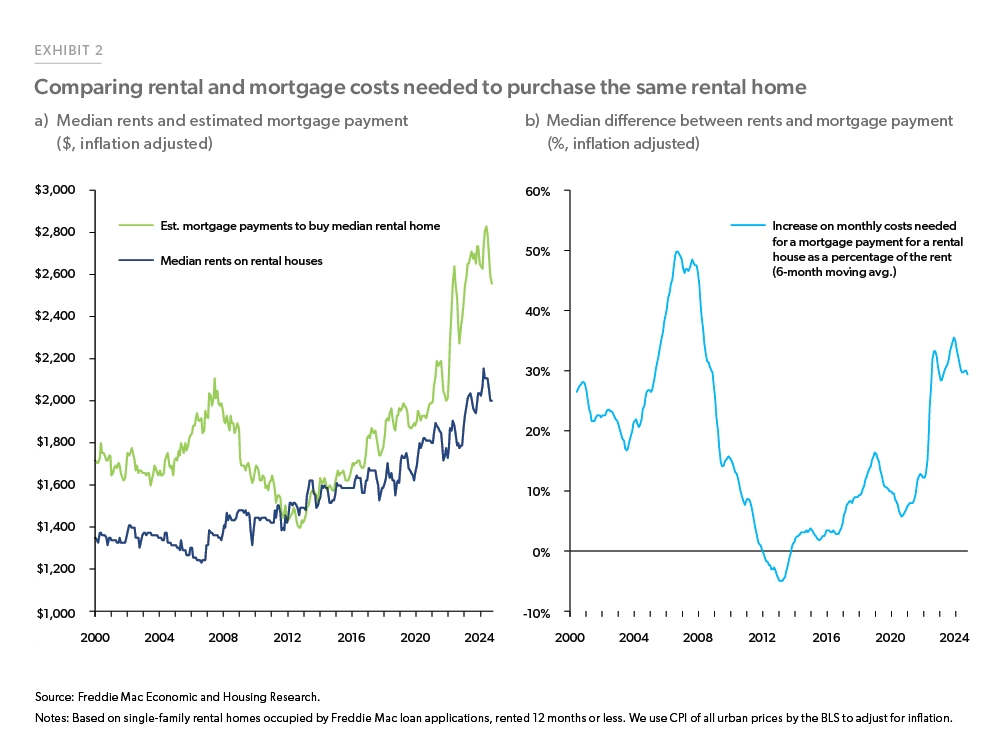

2. Housing Shortage & Increasing Rental Demand

- Median mortgage payment up 7.6% to $2,686 (Jan 2025).

- Rising mortgage rates push more people toward renting driving rental demand;

- Homeownership remains out of reach for many, sustaining high rental occupancy.

3. Interest Rate Outlook

- As long as mortgage rates stay above 6%, rental demand will continue to increase. If rates drops, property values will rise dramatically and your equity will build.

4. Operational Efficiency & Tenant Retention

- Newly constructed homes require minimal maintenance, reducing capital expenditures.

- Build-to-rent designs encourage longer tenant stays (avg. 3 years), lowering turnover costs.

5. Insurance

- Many assume Florida’s insurance rates are sky-high. But our experience says otherwise, after shopping policies, we found affordable annual premiums for these properties.

Properties Prices and Rents

Capital Requirements

Selling/Liquidating

About the Builder / Seller

This home builder has the capacity to construct over 500 units per year and currently controls more than 1,000 lots in prime Florida markets, ready for development or sale. With a strong focus on addressing the housing shortage, the company remains highly competitive in land acquisition and construction costs, creating opportunities in both single-family and multi-family residential projects.

Its current subdivisions and target markets are among the fastest-growing real estate areas in the U.S., attracting a strong and expanding population. The company’s finished homes stand out with high-quality construction and stylish design. An in-house design team ensures attention to detail, featuring granite countertops, hard surface flooring, stainless steel appliances, and strong curb appeal.

Backed by a team of 20 innovative professionals, the company operates on a fully integrated platform, managing everything from land acquisition and permitting to construction and real estate sales. Their in-house teams handle investment strategy, building, and property marketing, ensuring efficiency and seamless execution at every stage.

Total Migration by State in 2024

Florida continues to see strong domestic migration, particularly from high-tax, cold-weather states. The state remains one of the top choices for relocation due to its tax benefits, job opportunities, lifestyle appeal, and retiree-friendly environment.Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Source: Consumer Affairs

Florida locales dominated the 2024 U-Haul Growth Index, indicating the Sunshine State continues to be a sought-after destination.

Housing Shortage

The United States is experiencing a housing shortage, with estimates ranging from 3.8 million to 7.3 million units. This shortage is due to a combination of factors, including a decline in construction, high costs, and zoning restrictions.

Causes of Housing Shortage:

Construction Decline

A collapse in construction during previous years has left fewer homes being built

High Costs

High labor and material costs, as well as financing difficulties, have made it harder to build new homes

Zoning Restrictions

Zoning laws and land use restrictions can make it difficult for developers to build new homes

Unaffordability

Housing costs have outpaced income growth over the past two decades

Housing Shortage Estimates

The National Low Income Housing Coalition (NLIHC) estimates a shortage of 7.3 million affordable rental homes

Realtor.com estimates a shortage of 6.5 million homes

Fannie Mae estimates a shortage of 4.4 million homes

Up for Growth estimates a shortage of 3.8 million homes

The Pew Charitable Trusts estimates a shortage of 4 to 7 million homes

Ocala Market Overview

9.65% Growth Since 2020.

The current population of Ocala, Florida is 69,965 based on our projections of the latest US Census estimates (released May 2024).

The last official US Census in 2020 recorded the population at 63,808.

Actual Real Transaction (Jan. 2025)

A local homeowner recently bought one of these homes from the same builder we're working with. This is a real example of what someone paid compared to the price you're getting through this opportunity. This buyer purchased the home as a primary residence—not as a rental.

Location: Ocala, FL 34473

Bedroom: 4 | Bathrooms: 2 | Sq Ft: 1785 | Built: 2024 | Garage: 2

| Typical Retail Buyer | SDI Investor | SDI Discount Gains | |

| Purchase price | $335,000 | $295,000 | ($40,000) |

| Closing date | Jan 9, 2025 | TBD |

Is the house occupied or vacant?

Most of these houses are tenant occupied or will be leased before you close.

Can I self Manage?

Yes you can, and you can consider using RESI, Simply Do It's owner's self-managed hybrid eco-system.

Additional Photos

Disclaimer

This presentation is provided for informational and discussion purposes only and should not be relied upon or otherwise used in any manner by the recipient. No warranty is given as to the completeness or accuracy of the information contained herein and the views and opinions haerein are subject to change without notice.

This presentation is not part of, and should not be construed as part of, any offer to sell or any solicitation of an offer to buy any limited partnership or other interest in the subject property. Such an offer can only be made through the delivery of a private placement memorandum or subscription agreement Although forward-looking statements contained in this presentation are based upon what the sponsor believes are reasonable assumptions, there can be no assurance that forward-looking statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. The reader is cautioned not to place undue reliance on forward-looking statements.

In furnishing this presentation, the sponsor, reserves the right to supplement, amend or replace the information contained in this document at any time, but has no obligation to provide the recipient with any supplemental, amended, replacement or additional information.

The contents of this brochure are confidential and are not to be reproduced, copied, transferred, or communicated to any third party, without the prior written consent of the sponsor.