1031 Exchange – Tips to Help You Conduct a Successful Exchange

We've assisted numerous clients with their 1031 exchanges, which can be a fantastic opportunity to reposition and expand your portfolio (great for you!).

Here are some key tips:

1. Ensure you find and utilize a Qualified Intermediary (QI) early in the process.

2. Make sure your 1031 funds (during the exchange) are accessible and held in a place where you can reach them in case the QI becomes unavailable.

3. Check if you have passive losses from previous activities that you can use to offset profits instead of proceeding with a 1031 exchange.

4. A 1031 exchange can allow you to purchase one or multiple properties instead of just the one you're selling. It's crucial to know your options, and the QI will provide explanations.

5. Although technically you have 45 days to identify the property or properties you intend to purchase, with an additional 135 days to close, it's advisable to aim for an expedited process. We work with our clients to close on properties, even multiple ones, within the initial 45 days, which helps navigate challenges like limited inventory.

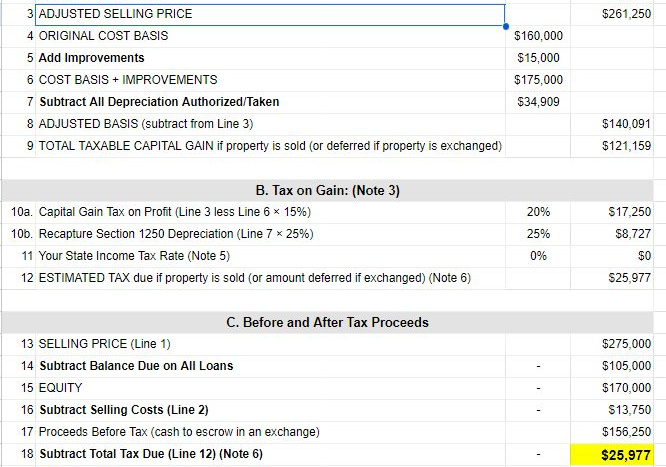

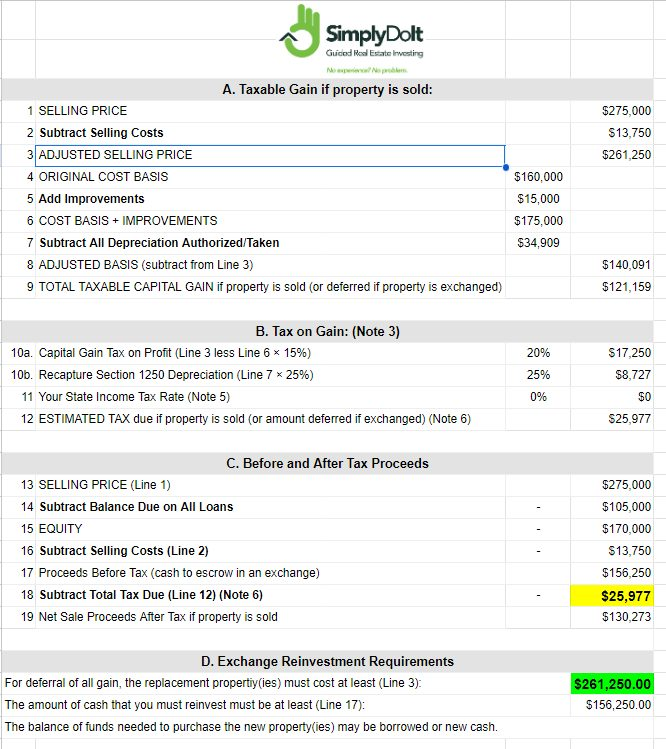

6. Ensure you calculate your taxes to determine if conducting an exchange is worthwhile (see example – table)

1. Ensure you find and utilize a Qualified Intermediary (QI) early in the process.

2. Make sure your 1031 funds (during the exchange) are accessible and held in a place where you can reach them in case the QI becomes unavailable.

3. Check if you have passive losses from previous activities that you can use to offset profits instead of proceeding with a 1031 exchange.

4. A 1031 exchange can allow you to purchase one or multiple properties instead of just the one you're selling. It's crucial to know your options, and the QI will provide explanations.

5. Although technically you have 45 days to identify the property or properties you intend to purchase, with an additional 135 days to close, it's advisable to aim for an expedited process. We work with our clients to close on properties, even multiple ones, within the initial 45 days, which helps navigate challenges like limited inventory.

6. Ensure you calculate your taxes to determine if conducting an exchange is worthwhile (see example – table)

Good luck

Dani Beit-Or | Simply Do It – Guided Real Estate Investing