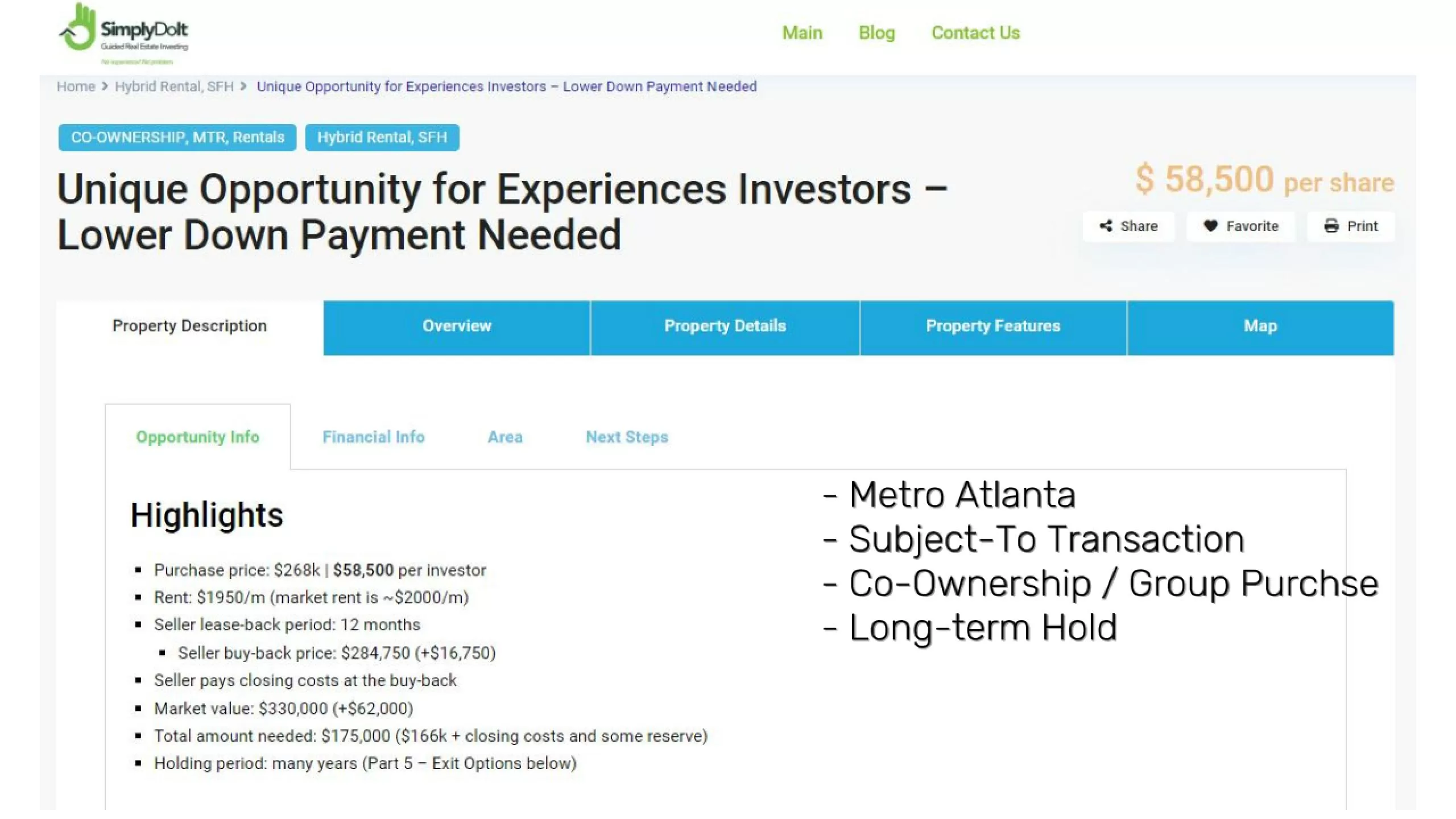

Unique Atlanta Property Deal Explained: $60K Investment; Co-Ownership; Special Terms

Summary

A complex investment opportunity for experienced investors involving a unique property deal in Atlanta.

Highlights

- 🏡 Unique property investment opportunity in Atlanta.

- 💼 Requires a minimum investment of $60,000.

- 🤝 Involves co-ownership with up to three investors.

- 🔄 Seller will rent back with an option to buy in 12 months.

- 📈 Potential for $117,000 profit if the seller buys back.

- ⚠️ Subject-to financing carries risks, including lender notification.

- 📊 Detailed financials and FAQs provided on the website.

Key Insights

💰 Group Investing Benefits: This deal allows experienced investors to pool resources, lowering individual financial exposure while maximizing potential returns. By collaborating, investors can also share insights and strategies, which can enhance decision-making. 🌐

🔍 Passive Investment Structure: The investment is designed for those seeking a more passive role in real estate. A third party will manage the operational aspects, which could be appealing to seasoned investors who own multiple properties and prefer to avoid hands-on management. 💤

📅 Long-Term Commitment: Investors should anticipate a commitment of five to ten years. This duration allows for market fluctuations and property appreciation, aligning with long-term investment strategies. ⏳

📊 Equity from Day One: The investment grants immediate equity, as the purchase price is below market value. This built-in equity serves as a financial cushion and a hedge against potential market downturns. 📈

⚠️ Subject-To Risks: The unique financing method, ‘subject to,’ presents risks such as potential lender objection. Understanding these risks is crucial for investors considering this strategy. 🚨

🔄 Exit Strategies: Various potential exit strategies exist, including extending the rental agreement or transitioning to traditional or hybrid rental models, providing flexibility based on market conditions. 🔄

🔗 Access to Detailed Info: Comprehensive details, including financials and FAQs, are available online, empowering investors to make informed decisions and ask relevant questions. 📚

Disclaimer

Information contained herein was obtained from sources deemed reliable, however, Simply Do It and/or the owner(s) of the property make no guarantees, warranties or representation as to the completeness or accuracy thereof. The presentation of the property is offered subject to errors, omissions, changes in price and/or terms, prior sale or lease or removal from the market for any reason without notice.

The analysis is provided “As Is”. All the information is believed to be accurate (except for the small effects of some simplifying assumptions), but is not guaranteed, and depends on the values entered for the property. This analysis is intended for the purpose of illustrative projections. The information provided is not intended to replace or substitute for any legal, accounting, investment, real estate, tax, or other professional advice, consultation, or service. Simply Do It and/or the owner(s) are not responsible nor liable for any damages arising from the use of the analysis info.