updated 9/18/2024

Highlights

- Purchase price: $350k

- Rent: $2750/m (market rent is ~$2750/m)

- Market value: $400,000 (+$50,000)

- Total amount needed: ~$135,000

- Holding period: many years (Part 5 – Exit Options below)

- This is an off-market deal, no agents are involved, BUT our local agent can be added to the transaction and his fee will be added to the price.

Why Consider This Investment

- Equity from day one ~$50K

- Strong cashflow ~$700/m

- No need to deal with lending and mortgage – this is a subject-to which means keeping the seller’s current mortgage rate (~2.75%) and terms.

Part 1 – Financing

This property is being bought “subject-to” the existing loan. This means the seller’s mortgage will stay as it is, but the property’s title will be transferred to the new buyer (you). The mortgage will remain in the seller’s name with no changes, while ownership of the property will move to you.

This property current mortgage terms are:

Rate: 2.75%

Balance: $226,000

P&I: $981

Loan Maturity Date: /1/12051

Part 2 – Group Purchase – OPTIONAL SCENARIO

This property CAN be purchased through a trust. A trust has a trustee and beneficiaries, and as an investor, you will be one of the beneficiaries. It can also be purchased by one (single) investor.

There will be up to THREE beneficiaries: Up to two investors, each investing about $65,000, and Simply Do It. Each investor will receive 40% equity in the trust, while Simply Do It will receive 20%.

Simply Do It, or one of its agents or affiliates, will manage the property. This includes handling communication with the seller-tenant, dealing with the mortgage and insurance, and coordinating with vendors and service providers. This setup makes it a more passive investment for you.

Part 3 – Exit Options

Option 1 – seller-tenant executes the option to buy it back after 12 months

Option 2 – seller-tenant requesting to extend the buy-back option period

Option 3 – seller-tenant extends the lease on the property after 12 months

Option 4 – seller-tenant vacates the property and property is put back in the rental market as a traditional rental (the mortgage terms stay the same)

Option 5 – we convert this property to a Hybrid Rental, which will require and additional investment of approx. $25,000 but with a potential to X% the cashflow.

Option 6 – hold property for many years and refi or sell after in 5 or 7, or 10 years.

Part 4 – RISKS

Disclaimer

Information contained herein was obtained from sources deemed reliable, however, Simply Do It and/or the owner(s) of the property make no guarantees, warranties or representation as to the completeness or accuracy thereof. The presentation of the property is offered subject to errors, omissions, changes in price and/or terms, prior sale or lease or removal from the market for any reason without notice.

The analysis is provided “As Is”. All the information is believed to be accurate (except for the small effects of some simplifying assumptions), but is not guaranteed, and depends on the values entered for the property. This analysis is intended for the purpose of illustrative projections. The information provided is not intended to replace or substitute for any legal, accounting, investment, real estate, tax, or other professional advice, consultation, or service. Simply Do It and/or the owner(s) are not responsible nor liable for any damages arising from the use of the analysis info.

The following is the full transaction financial info (not broken into multiple partners):

Property Specifications | |

| Bedrooms | 4 |

| Bathrooms | 3 |

| Square Feet | 2983 |

| Year Built | 2007 |

| Garage Size | 2 |

| Schools Rating (scale 3-30, 30 is best) | 14 |

| Lot size (sq ft) | 10,454.0 |

Purchase Assumptions | My Offer |

| Offer used for analysis | $350,000 |

| Suggested offer (low) | $350,000 |

| Suggested offer (high) | $350,000 |

| Asking | $350,000 |

| Market Value (after improvements) | $400,000 |

| Day-1 Equity | $50,000 |

| Estimated Improvements (lower) | $6,500 |

| Estimated Improvements (upper) | $8,500 |

| Estimated Closing Costs | $3,500 |

| Estimated Mortgage Costs | $0 |

| Other Fees At Closing (pts, . . . ) | $10,000 |

| Total Cost (estimated) | $371,000 |

| Original listing date | 7/12/24 |

Estimated Financial Assumptions | Monthly | Yearly | ||

| $2,550 | $2,600 | $31,200 | |

| Rent (lower)* | $2,500 | $30,000 | ||

| Property Taxes | $185 | $2,220 | ||

| Insurance | $170 | $2,040 | ||

| Repairs | 75 | $75 | $900 | |

| Property Management Monthly (%) | 0.0% | |||

| Property Management Monthly ($) | $75 | $900 | ||

| Leasing Fee | 100% | $106.3 | $1,275 | |

| HOA or Fixed Costs | $248 | $2,976 | ||

| Vacancy Rate | 4.0% | |||

| Total Fixed Expenses | 37.6% | $958 | $11,499 | |

| Total Expenses (Fixed + Mortgage) | $1,930 | $23,158 | ||

Financial Analysis / Deal Attractiveness | ||

| Years: | 5 | 10 |

| Cap Rate | 6.6% | 8.1% |

| Net Cash Flow | $44,102 | $107,217 |

| Equity Increase | $114,041 | $250,889 |

| Total Gain | $158,143 | $358,106 |

| Average Cash Flow/Year | $8,820 | $10,722 |

| Average Cash Flow/Month | $735 | $893 |

| Average Gain/Year | $31,629 | $35,811 |

| Average ROI | 118.9% | 269.3% |

| Annual ROI | 23.8% | 26.9% |

| Projected Property Value | $486,661 | $592,098 |

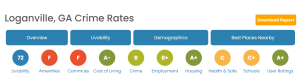

image provided by AreaVibe

Crime: low. More demographic data

Schools: 5 | 5 | 4 – Note: most of the Atlanta metro schools have low(er) rating, and a 12 total rating is not uncommon to see – in other words it is “normal”.

Distance to downtown Atlanta: 35 mins | 45 minutes – 1 hour

Investing in Loganville, GA: What You Need to Know

Loganville, Georgia, is a growing small city with a population of about 15,000 and 15 distinct neighborhoods. The area has seen a lot of new real estate development, which indicates a healthy local economy and a steady influx of new residents. With a median household income of $77,750, the city shows signs of a stable and improving market, which can be promising for investors.

While Loganville’s real estate is among the more expensive in Georgia, it remains more affordable compared to other parts of the U.S. This provides opportunities for investors looking to tap into a strong local market with room for growth.

For remote investors, it’s worth noting that about 9.45% of Loganville’s workforce works from home, higher than many areas. This trend is growing and could make Loganville appealing to renters who value remote work opportunities. However, the average commute time for local workers is 39 minutes, which is longer than the national average, potentially influencing the demand for housing closer to major employment hubs.

Loganville doesn’t have a public transit system, meaning most residents rely on cars. For investors, this could mean higher demand for homes with ample parking or proximity to major roads.

The city’s demographic is diverse, with significant Black, White, and Hispanic communities, adding to its cultural richness. The local population is relatively well-educated, with 27.5% of adults holding a bachelor’s degree or higher, which can support a demand for quality rental properties.

With a per capita income of $38,677, Loganville is relatively affluent for Georgia, making it a good location for long-term rental investments. However, it’s important to note the economic diversity, as the area has both wealthy and lower-income residents.

For investors unfamiliar with Loganville, this market offers a combination of strong economic indicators, recent real estate development, and growing demand for both owner-occupied and rental properties. It could be a solid choice for those looking to invest remotely in a stable and diverse community.

- Contact Simply Do It with additional questions. meet@simplydoit.net

- Once interested, we will send you the trust (in formation) documents to review and sign.

- Once signed, a $3,000 commitment fund will be required to secure your position. $3,000 is non-refundable, unless the transaction falls through, such as not passing inspection or any other reason that will prevent from purchasing this property.

- The rest of your funds are due when singing the purchase agreement (aka contract assignment). This is a pre-negotiated deal so there is no offer and negotiation phase.

- After singing the purchase contract, contract assignment, inspection will be ordered, escrow & title accounts will be opened.

- If there are no major issues with the inspection, closing will take place next.

Contact Simply Do It

FAQs - About Co-Ownership

Simply Do It or one of it agents/affiliates will be the one who sees the day to day of this investment.

Minor decisions are made by the operation manager, such as approving a repair, approving a tenant, deciding on an insurance, etc.

Major decisions are made together with the group, such as if to sell or not, if to refi or not, if to invest more into converting to a Hybrid Rental or stay with traditional long term, etc.

You should make the assumption that selling your interests will be very challenging so assume it will be difficult. That being said another group member may be interested in buying it. Simply Do It or Operation Manager will need to approve any new member.

Simply Do It reserves the right to buy out any member if necessary. For example, while it’s not very likely, if a member is acting in a way that could harm the investment, they may need to be bought out to protect the overall investment.

To protect the overall investment, Simply Do It will hold an executive role in decision-making. If the members cannot agree on a major decision, Simply Do It will have the authority to make the final call.

The assumption is that most sellers won’t buy the property back. This is mainly because they likely won’t qualify for financing or simply won’t want to repurchase it. The sale-leaseback arrangement is more of a “sell now, move later” program.

A trust issues a K1 just like an LLC does. Unfortunately, we’ve also had cases where the K1s were ready later than we would have liked. Here’s what typically happens: We aim to have taxes done by the end of December, but the CPA is usually waiting for updated tax documents from the IRS. For various reasons, these documents often aren’t available until late January (which is pretty common). As a result, the K1s are typically only ready in March or April. If this delay is a concern for you, this investment might not be a good fit.

Losses are passed through to you based on your percentage of ownership, just as if you didn’t have a separate entity and your tax/financial activity is a portion of the deal.

The profits will be treated as long-term capital gains, similar to holding an asset for more than 12 months, but it’s not just about the duration; intent also matters in taxation. In reality, 99% likely, it will take at least 12 months plus additional days until the sale closes.

We collect rent upfront for 12 months, and because cash flow is tight, we keep all the rent as a reserve. The final distribution happens when we sell the property after a year or based on meeting certain reserve requirements, on a quarterly basis after the 1st year.

Major decisions like re-leasing, selling, or refinancing are made based on voting rights. Minor decisions, like choosing insurance or how to handle a maintenance issue, are made by the operations manager.

- Updated On:

- September 18, 2024

- 4 Bedrooms

- 3 Bathrooms

- Garage Garages

- 2,983.00 ft2

- Year Built:2007

- Principal and Interest

- Property Tax

- HOA fee