Navigating Real Estate Decisions Amidst High Interest Rates | Simply Do It by Dani Beit-Or

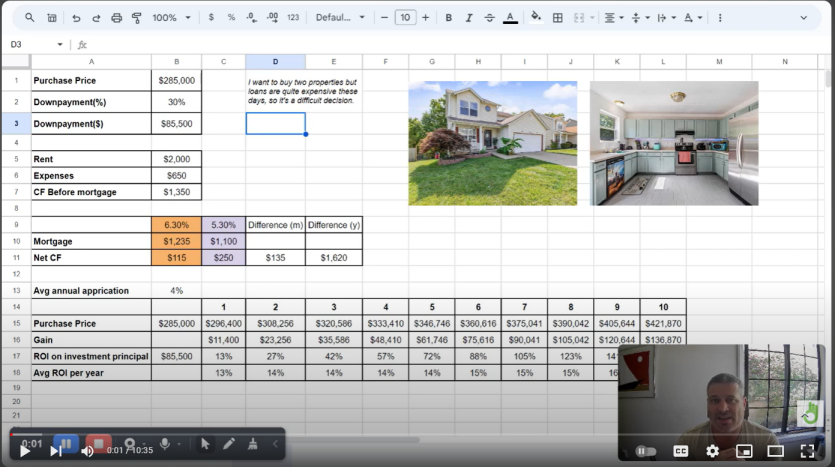

Summary Dani Beit-Or discusses the current high interest rates on loans, emphasizing the need to evaluate the real costs and benefits of property investment.

Video: youtu.be/-KUcKjbtJRs

Podcast: spotifyanchor-web.app.link/e/TJIvRk8nhMb

Highlights 💰 Interest rates are currently around 6.3-6.5%. 📉 A 1% difference in rates can greatly affect monthly cash flow. 📈 Real estate typically appreciates over time, potentially offsetting higher rates. ⏳ Waiting for lower rates may result in higher property prices. 🔄 Refinancing can improve cash flow in the future. 🏡 Investing now secures current property prices rather than future increases. ❓ Evaluating what constitutes a “normal” interest rate is crucial.

Key Insights 💭 Understanding Interest Costs: While interest rates seem high, it’s essential to analyze the actual dollar impact on cash flow, which may be less than expected. 📊 Market Appreciation: Even with higher interest rates, properties can appreciate significantly over time, potentially yielding a good return on investment. 🕰️ Timing the Market: Waiting for lower rates can lead to missed opportunities as property values may rise, making future purchases more expensive. 🔍 Long-Term Perspective: It’s beneficial to consider long-term gains from real estate rather than focusing solely on immediate interest costs. 🔧 Refinancing Opportunities: Securing a property now allows for future refinancing, which can lower interest rates and improve cash flow without losing initial investment value. 📈 Normalizing Rates: Understanding what constitutes a normal interest rate is vital; rates fluctuate, and current rates may not be as unfavorable as perceived. 💡 Action Over Inaction: Rather than waiting for perfect conditions, taking action can lead to better financial outcomes in the evolving real estate market.

To learn more, reach out to Dani Beit-Or, CEO of Simply Do It at https://simplydoit.net/

Subscribe / simplydo. .

/ simplydo. .

🏘 🏚 Interested in rental properties? Check out our most up to date inventory here: https://reistart.com/

EMAIL Simply Do It for questions: meet@simplydoit.net

Check out our real estate investing class: https://www.resmarts.co/

🎤Podcast on Spotify: https://open.spotify.com/show/5Pg307q...

🎤Podcast on Google: https://www.google.com/podcasts?feed=...

🎤Podcast on Apple: https://itunes.apple.com/us/podcast/g...

🎤Podcast on Anchor: https://anchor.fm/simplydoit

Podcast in HEBREW – Investalk US Real Estate Investing in Hebrew – השקעות נדלן בארהב

🎤Podcast on Spotify: https://open.spotify.com/show/4YXJ7dl...

🎤Podcast on Apple:

🎤Podcast on Anchor: https://anchor.fm/simplydo

Podcast: spotifyanchor-web.app.link/e/TJIvRk8nhMb

Highlights 💰 Interest rates are currently around 6.3-6.5%. 📉 A 1% difference in rates can greatly affect monthly cash flow. 📈 Real estate typically appreciates over time, potentially offsetting higher rates. ⏳ Waiting for lower rates may result in higher property prices. 🔄 Refinancing can improve cash flow in the future. 🏡 Investing now secures current property prices rather than future increases. ❓ Evaluating what constitutes a “normal” interest rate is crucial.

Key Insights 💭 Understanding Interest Costs: While interest rates seem high, it’s essential to analyze the actual dollar impact on cash flow, which may be less than expected. 📊 Market Appreciation: Even with higher interest rates, properties can appreciate significantly over time, potentially yielding a good return on investment. 🕰️ Timing the Market: Waiting for lower rates can lead to missed opportunities as property values may rise, making future purchases more expensive. 🔍 Long-Term Perspective: It’s beneficial to consider long-term gains from real estate rather than focusing solely on immediate interest costs. 🔧 Refinancing Opportunities: Securing a property now allows for future refinancing, which can lower interest rates and improve cash flow without losing initial investment value. 📈 Normalizing Rates: Understanding what constitutes a normal interest rate is vital; rates fluctuate, and current rates may not be as unfavorable as perceived. 💡 Action Over Inaction: Rather than waiting for perfect conditions, taking action can lead to better financial outcomes in the evolving real estate market.

What is guided investing? Guided real estate investing is a hands-on approach to real estate investing created for beginners. Rather than only providing courses, we guide you through the entire process from pre-purchase to post-purchase.

Once we help establish your goals and create a custom strategy, we help you select your investment property, guiding you and teaching you every step of the way.

We believe that beginner real estate investing shouldn’t be taught in theory but in practice. With experts by your side, risk is mitigated and training is much more effective. Learn more:

To learn more, reach out to Dani Beit-Or, CEO of Simply Do It at https://simplydoit.net/

Subscribe

🏘 🏚 Interested in rental properties? Check out our most up to date inventory here: https://reistart.com/

EMAIL Simply Do It for questions: meet@simplydoit.net

Check out our real estate investing class: https://www.resmarts.co/

🎤Podcast on Spotify: https://open.spotify.com/show/5Pg307q...

🎤Podcast on Google: https://www.google.com/podcasts?feed=...

🎤Podcast on Apple: https://itunes.apple.com/us/podcast/g...

🎤Podcast on Anchor: https://anchor.fm/simplydoit

Podcast in HEBREW – Investalk US Real Estate Investing in Hebrew – השקעות נדלן בארהב

🎤Podcast on Spotify: https://open.spotify.com/show/4YXJ7dl...

🎤Podcast on Apple:

🎤Podcast on Anchor: https://anchor.fm/simplydo